BTC Price Prediction: Analyzing the Path to New Highs Amid Market Turbulence

#BTC

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Potential Upside

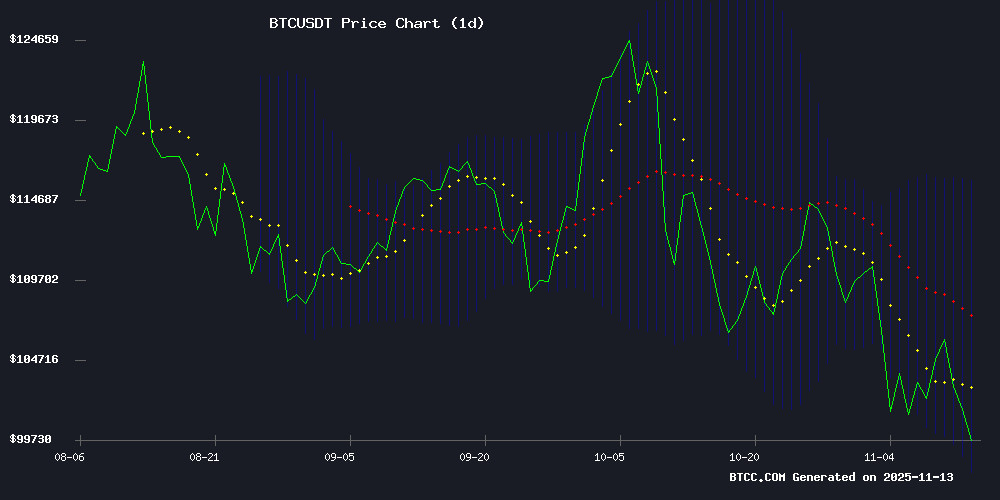

BTCC financial analyst Emma notes that Bitcoin is currently trading at $103,200, slightly below its 20-day moving average of $106,970. The MACD indicator shows bullish momentum with a positive histogram (986.95), while Bollinger Bands suggest the price is testing support near $98,298. 'The technical setup shows BTC is consolidating after recent volatility,' says Emma. 'A break above the middle Bollinger Band at $106,970 could signal renewed upward momentum.'

Mixed Market Sentiment as Institutional Adoption Grows

BTCC financial analyst Emma observes conflicting signals in market sentiment. 'While headlines show regulatory concerns and liquidations, we're seeing growing institutional interest through vehicles like IBIT and corporate holdings,' Emma notes. 'The $100K psychological level is holding as support despite bearish narratives about seasonal patterns.' The analyst highlights BlackRock CEO's endorsement of bitcoin as digital gold as particularly significant for long-term adoption.

Factors Influencing BTC's Price

Japan Exchange Considers Stricter Rules for Bitcoin-Hoarding Firms Amid Retail Losses

Japan Exchange Group (JPX) is weighing tighter regulations on listed companies accumulating Bitcoin, following significant losses by retail investors. The move targets so-called Digital Asset Traders (DATs), which have prioritized crypto holdings over traditional business operations.

Potential measures include stricter enforcement of backdoor listing rules, mandatory re-audits, and financing restrictions for firms focused on cryptocurrency accumulation. JPX has already intervened to pause listing plans for three prospective DATs.

Japan currently leads Asia with 14 publicly traded Bitcoin-buying firms. Metaplanet, the largest among them, has seen its value plummet more than 75% since June—a stark warning for investors chasing crypto-exposed stocks.

Bitcoin Holds Steady Near $100K as Market Awaits Next Catalyst

Bitcoin's price action has entered a phase of consolidation, oscillating near the psychologically significant $100,000 level. The cryptocurrency appears to be forming a base at this threshold, with technical indicators suggesting potential accumulation before the next leg up.

Market analysts observe an unusual decoupling from traditional liquidity measures, with Bitcoin's price movement diverging from the M2 money supply. This anomaly may persist until anticipated Federal Reserve liquidity injections materialize in 2025.

The weekly chart reveals critical support at the 55-week moving average, while RSI levels mirror historical reversal points. Notably, the feared 'death cross' pattern has repeatedly preceded rallies rather than declines in this cycle.

ASX Trader Analyzes Bitcoin's Predictable Trends and 2026 Market Risks

Bitcoin's recent price fluctuations below $100,000 were anticipated by ASX Trader David Bird, who cited historical patterns and weakening market sentiment. The cryptocurrency's surge to $125,000 occurred amid low trading volumes and divergence—a classic sign of exhaustion.

Bird contrasted Bitcoin's performance with MicroStrategy's 3700% gains, suggesting institutional players may be hedging bets. His analysis warns of broader financial market headwinds by 2026, though Bitcoin's cyclical behavior remains mechanically reliable.

MicroStrategy Stock Plummets Amid Bitcoin Downturn, Raising Treasury Liquidity Concerns

MicroStrategy's Nasdaq-listed shares (MSTR) have tumbled 60% from their $543 peak, now trading at $224.20 as Bitcoin's 10% monthly decline pressures the corporate holder's massive crypto treasury. The business intelligence firm's 641,692 BTC stash—valued at $65 billion—faces potential liquidation if its market-adjusted net asset value (mNAV) metric breaches the critical 1.0 threshold.

Analyst Andreas Steno Larsen warns of possible Bitcoin sales to fund share buybacks should mNAV deteriorate further. The stock's performance remains tightly coupled with Bitcoin's price action, reflecting MicroStrategy's unconventional transformation into a leveraged Bitcoin proxy. Market observers now scrutinize whether Michael Saylor's high-conviction bet can withstand prolonged crypto winter conditions.

Morgan Stanley Warns of Bitcoin's 'Fall Season' as Market Signals Weaken

Morgan Stanley strategists sound the alarm on Bitcoin's cyclical downturn, comparing current conditions to autumn's profit-taking phase before a potential crypto winter. The flagship cryptocurrency breached key support at $99,000 on November 5 amid faltering institutional inflows.

"We're harvesting gains now before winter sets in," said Denny Galindo, Morgan Stanley's investment strategist, referencing Bitcoin's historical three-year bull markets followed by sharp corrections. ETF flows and stablecoin reserves show liquidity drying up despite persistent institutional interest in Bitcoin as digital gold.

Technical breakdowns coincide with slowing momentum across crypto markets. While long-term adoption narratives remain intact, regulatory hurdles continue delaying meaningful capital allocations from traditional finance players.

Crypto Market Slides as Bitcoin Leads Broad Sell-Off Amid Liquidation Fears

The cryptocurrency market extended its decline on Wednesday, with Bitcoin shedding another 2% to dip below $102,000. Total market capitalization slipped to $3.42 trillion as bearish sentiment gripped traders across exchanges.

Spot ETF flows show dwindling capital inflows, with Bitcoin's aggregate open interest hitting seven-month lows. Polymarket traders are now wagering on further downside, with some contracts pricing a potential break below $100,000.

Leveraged positions bore the brunt of the sell-off, with $612 million liquidated in 24 hours. Hyperliquid, the decentralized exchange, fueled additional anxiety after its bridge halted withdrawals temporarily - though platform representatives later confirmed normal operations had resumed.

iShares Bitcoin Trust (IBIT) Extends Losses Amid Bitcoin Price Volatility

The iShares Bitcoin Trust (IBIT) fell 1.54% to $57.45 today, extending its 5-day decline to 6.23%. Year-to-date gains now stand at 9.99%, as the ETF mirrors Bitcoin's 1.68% drop to $101,288.42.

Market uncertainty prevails as investors weigh macroeconomic risks against potential Fed rate cuts. The Wall Street Journal reports deepening divisions among policymakers, with the September rate decision now appearing increasingly uncertain.

TipRanks data shows a Strong Sell consensus for IBIT, with 14 Bearish ratings outweighing 3 Bullish calls. Retail investors aged 35-55 remain the most active buyers, though overall portfolio exposure stays modest at 1.9%.

BlackRock CEO Larry Fink Highlights Bitcoin's Role as Digital Gold Amid Rapid Crypto Growth

BlackRock CEO Larry Fink positioned Bitcoin as a modern safe-haven asset during his keynote at the Global Financial Leaders’ Investment Summit 2025 in Hong Kong. "There is a role for Gold and there is a role for Bitcoin," Fink stated, framing both as hedges against currency depreciation and economic instability. The comparison comes as digital wallets now hold over $1.4 trillion in assets—a testament to accelerating institutional adoption.

Tokenization emerged as a central theme, with Fink predicting blockchain-based ETFs and other securities will drive market efficiency. The $10 trillion asset manager's bullish stance follows its successful Bitcoin ETF launch earlier this year. Meanwhile, AI was flagged as a transformative force for personalized investing strategies and real-time risk analysis.

SEC’s New Cryptocurrency Classification Guidelines Shift Market Dynamics

The U.S. Securities and Exchange Commission (SEC) has introduced updated guidelines for classifying cryptocurrencies, marking a pivotal moment for the digital asset industry. Under the leadership of new Chairman Paul, the SEC clarified that while most cryptocurrencies are not securities, certain tokens may still meet the criteria of investment contracts under federal law. This decision stems from the agency’s Project Crypto initiative, launched post-Trump election, to address long-standing regulatory ambiguities.

Historically, the Howey test has been applied flexibly to determine whether cryptocurrencies qualify as securities. The SEC now plans to enforce a more advanced version of this test, aiming to bring clarity to a market plagued by legal uncertainty. Bitcoin’s outlook remains bearish amid these developments, while traditional safe-haven assets like gold gain traction.

The classification’s significance cannot be overstated. For years, the lack of a clear framework has created chaos in legal rights and treatments for digital assets. The SEC’s move is expected to shape the future of cryptocurrencies both domestically and globally, influencing investor sentiment and institutional adoption.

Gold Outshines Cryptocurrencies Amid Market Turbulence

Gold prices surged to $4,200 as cryptocurrencies faced downward pressure, reflecting broader market unease. The impending end of the U.S. government shutdown failed to buoy digital assets, with Bitcoin and others extending recent losses.

Traditional safe-havens gained favor as silver futures jumped 10% weekly, trading above $53. Meanwhile, corporate earnings from Palantir to Tesla mirrored crypto's struggles, underscoring risk-off sentiment across asset classes.

While resolved political uncertainty typically benefits cryptocurrencies, the current flight to precious metals suggests lingering macroeconomic concerns may continue weighing on digital assets in the near term.

Bitcoin’s Corporate Holdings Diversify as Institutional Adoption Grows

Michael Saylor’s MicroStrategy remains the dominant player in corporate Bitcoin ownership, but its market share is shrinking as more institutions enter the space. The firm now holds 640,808 BTC, accounting for 60% of total corporate holdings—down from 75% earlier this year.

October saw a record 353 entities reporting Bitcoin balances, including 276 public and private companies. Japan’s Metaplanet emerged as a major buyer, acquiring 5,268 BTC to become the fourth-largest corporate holder. Coinbase CEO Brian Armstrong publicly confirmed the exchange’s continued accumulation, adding 2,772 BTC in Q3 with a clear endorsement: "Coinbase is long bitcoin."

Despite slower monthly growth—just 14,400 BTC added collectively in October—the broadening distribution signals maturing institutional adoption. The United States maintains leadership in corporate crypto adoption, though Asia-Pacific entrants like Metaplanet are gaining ground.

How High Will BTC Price Go?

Based on current technicals and market conditions, BTCC analyst Emma suggests:

| Scenario | Price Target | Conditions |

|---|---|---|

| Bullish Breakout | $115,600-$120,000 | Sustained move above 20MA with MACD expansion |

| Neutral Range | $98,300-$106,900 | Continued consolidation within Bollinger Bands |

| Bearish Case | $90,000 support | Break below lower Bollinger Band with high volume |

'The $100K level remains critical psychological support,' Emma emphasizes. 'Institutional flows could drive the next leg up if technical resistance breaks.'

- BTC holds critical support at $100K despite bearish headlines

- Technical indicators show potential for upside breakout above $106,970

- Institutional adoption growing despite short-term market turbulence